Multiple Choice

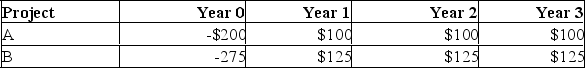

Use the following mutually exclusive investment cash flows for the question(s) below:  If the discount rate is 14%, using profitability index which of the following is true?

If the discount rate is 14%, using profitability index which of the following is true?

A) The PI of project A is less than 1.0

B) The PI of project B is less than 1.0

C) Based on the PI, project A is preferable

D) Both projects would be rejected based on the PI criterion

E) Based on the two PI's, it is obvious the IRR for both projects is less than 14%

Correct Answer:

Verified

Correct Answer:

Verified

Q86: A project has average net income of

Q87: Net present value _.<br>A) Is equal to

Q88: Without using formulas, provide a definition of

Q89: Which of the following is true about

Q90: What is the internal rate of return

Q92: A 25- year project has a cost

Q93: Bill plans to open a do-it-yourself dog

Q94: A conventional cash flow is defined as

Q95: Both net present value and the internal

Q96: Calculate the NPV of a 20-year project