Multiple Choice

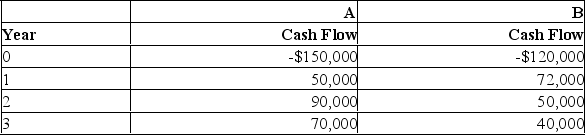

You have a choice between two mutually exclusive investments. If you require a 14% return, which investment should you choose?

A) Project B, because it has a smaller initial investment.

B) Project A, because it has a higher NPV.

C) Either one, because they have the same profitability indexes.

D) Project B, because it has the higher internal rate of return.

E) Project B, because it pays back faster.

Correct Answer:

Verified

Correct Answer:

Verified

Q96: Calculate the NPV of a 20-year project

Q97: The _ produces a ranking of all

Q98: A payback period that is less than

Q99: In actual practice, managers frequently use the

Q100: Atlantic, Inc. is considering a project that

Q102: AAR is biased in favour of liquid

Q103: If the required return is 12%, what

Q104: You are analyzing the following two mutually

Q105: Without using formulas, provide a definition of

Q106: When multiple IRR's exist, a project must