Multiple Choice

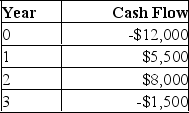

You are considering an investment with the following cash flows. If the required rate of return for this investment is 13.5 %, should you accept it based solely on the internal rate of return rule? Why or why not?

A) yes; because the IRR exceeds the required return

B) yes; because the IRR is a positive rate of return

C) no; because the IRR is less than the required return

D) no; because the IRR is a negative rate of return

E) You cannot apply the IRR rule in this case because there are multiple IRRs.

Correct Answer:

Verified

Correct Answer:

Verified

Q124: Generally, the most difficult part of utilizing

Q125: Project A has a cost of $300

Q126: A project produces annual net income of

Q127: Which capital investment evaluation technique is described

Q128: When the decision to accept or reject

Q130: What is the net present value of

Q131: Which of the following is considered to

Q132: Graphing the crossover point helps explain:<br>A) Why

Q133: You are considering a project that costs

Q134: A project has an initial investment of