Multiple Choice

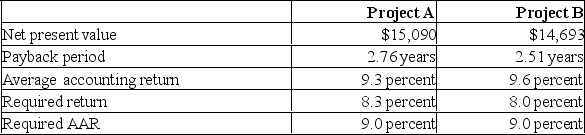

Matt is analyzing two mutually exclusive projects of similar size and has prepared the following data. Both projects have 5 year lives.  Matt has been asked for his best recommendation given this information. His recommendation should be to accept:

Matt has been asked for his best recommendation given this information. His recommendation should be to accept:

A) Project B because it has the shortest payback period.

B) Both projects as they both have positive net present values.

C) Project A and reject project B based on their net present values.

D) Project B and reject project A based on their average accounting returns.

E) Project B and reject project A based on both the payback period and the average accounting return.

Correct Answer:

Verified

Correct Answer:

Verified

Q405: The _ decision rule is considered the

Q406: When computing the net present value of

Q407: You are considering a project with an

Q408: What is the NPV of the following

Q409: Use the following mutually exclusive investment cash

Q410: NPV and IRR can lead to different

Q411: The profitability index calculation takes the time

Q412: Net present value is the preferred method

Q413: A project costs $475 and has cash

Q415: What is the payback period for the