Multiple Choice

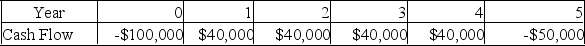

You are considering an investment with the following cash flows. Your required return is 10%, you require a payback of three years and a discounted payback of four years. If your objective is to maximize your wealth, should you take this investment?

A) Yes, because the payback is 2.5 years.

B) Yes, because the discounted payback is four years.

C) Yes, because both the payback and the discounted payback are less than two years.

D) No, because the NPV is negative.

E) No, because the project has a large negative cash flow at the end of its life.

Correct Answer:

Verified

Correct Answer:

Verified

Q226: Which of the following does NOT incorporate

Q227: Which of the following ranks decision rules

Q228: Floyd Clymer is the CFO of Bonavista

Q229: You are considering a project with an

Q230: A 50- year project has a cost

Q232: The initial cost of an investment is

Q233: Ginny Trueblood is considering an investment which

Q234: The primary reason that company projects with

Q235: Would you accept a project which is

Q236: An element of the IRR concept is