Multiple Choice

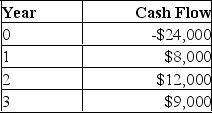

An investment has the following cash flows. Should the project be accepted if it has been assigned a required return of 9.5 %? Why or why not?

A) Yes; because the IRR exceeds the required return by about 0.39 %.

B) Yes; because the IRR is less than the required return by about 3.9 %.

C) Yes; because the IRR is positive.

D) No; because the IRR exceeds the required return by about 3.9 %.

E) No; because the IRR is 9.89 %.

Correct Answer:

Verified

Correct Answer:

Verified

Q312: Floyd Clymer is the CFO of Bonavista

Q313: The profitability index is closely related to:<br>A)

Q314: You are considering two independent projects both

Q315: If financial managers only invest in projects

Q316: Jack is considering adding work jeans and

Q318: The internal rate of return (IRR) is

Q319: Net present value is highly independent of

Q320: According to the text, the NPV rule

Q321: The payback period and discounted payback are

Q322: The internal rate of return (IRR) rule