Multiple Choice

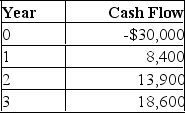

An investment has the following cash flows. Should the project be accepted if it has been assigned a required return of 14 %? Why or why not?

A) No; The IRR exceeds the required return by about 1.08 %.

B) No; The IRR is less than the required return by about 0.97 %.

C) Yes; The IRR exceeds the required return by about 1.08 %.

D) Yes; The IRR is less than the required return by about 0.97 %

E) Yes; The IRR is less than the required return by about 1.08 %.

Correct Answer:

Verified

Correct Answer:

Verified

Q23: The payback method:<br>A) Entails difficult computations.<br>B) Is

Q24: Without using formulas, provide a definition of

Q25: If you want to review a project

Q26: Two projects that are mutually exclusive are

Q27: You are considering two independent projects, both

Q29: The average accounting rate of return:<br>A) Is

Q30: A 30 year project is estimated to

Q31: A project should be accepted when the:<br>A)

Q32: List and briefly discuss the advantages and

Q33: You are analyzing a project and have