Multiple Choice

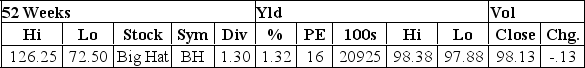

Assume that Big Hat paid a $1.12 annual dividend in the previous period. What is the dividend growth rate based on this quote?

Assume that Big Hat paid a $1.12 annual dividend in the previous period. What is the dividend growth rate based on this quote?

A) 1.16%

B) 12.20%

C) 14.15%

D) 16.07%

E) 16.29%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q47: The Extreme Reaches Corp. last paid a

Q100: The total rate of return earned on

Q101: The Herb Garden common stock sells for

Q102: Bradley Broadcasting expects to pay dividends of

Q103: Tom's Health Clinic just paid a $4.40

Q104: As a common shareholder in a firm,

Q106: RTF, Inc. common stock sells for $22

Q107: The dividend growth model considers capital gains

Q109: If Russian Motors closed at $22 and

Q110: Cumulative voting is the procedure whereby a