Multiple Choice

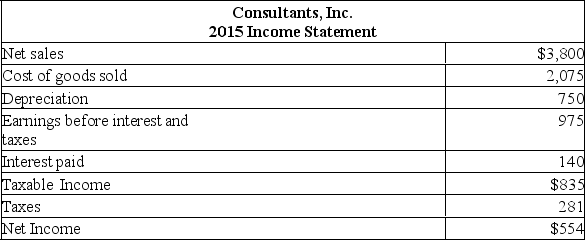

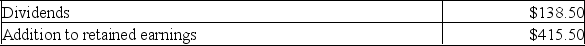

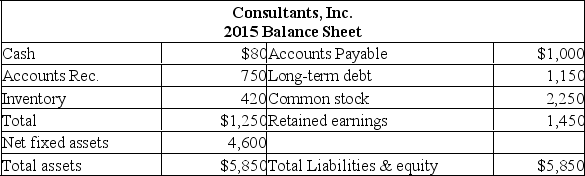

Consultants, Inc. is currently operating at full capacity. The profit margin and the dividend payout ratio are constant. Net working capital and fixed assets vary directly with sales. Sales are projected to increase by 5%. What is the external financing needed?

Consultants, Inc. is currently operating at full capacity. The profit margin and the dividend payout ratio are constant. Net working capital and fixed assets vary directly with sales. Sales are projected to increase by 5%. What is the external financing needed?

A) -$293.78

B) -$193.78

C) $122.50

D) $292.50

E) $367.27

Correct Answer:

Verified

Correct Answer:

Verified

Q110: If the Ballard Institute currently operates at

Q111: The following balance sheet and income statement

Q112: A Toronto firm wants to maintain a

Q113: How would you respond to a business

Q114: If a firm is operating at full

Q116: Given the following information, calculate sales value.

Q117: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What

Q118: The firm's investment and financing decisions are

Q119: Provide five advantages that planning can achieve.

Q120: By developing a financial plan, a firm