Multiple Choice

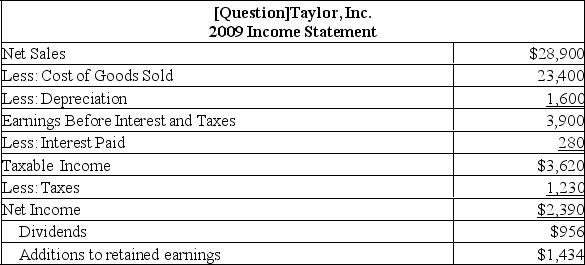

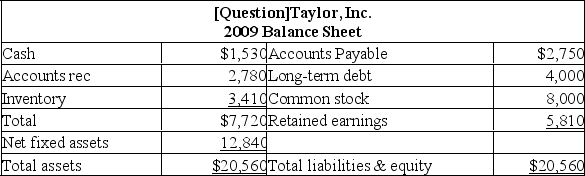

The following balance sheet and income statement should be used:

Assume that Taylor, Inc. is operating at 85% of capacity. All costs and net working capital vary directly with sales. What is the amount of total fixed assets required if sales are projected to increase by 20 percent?

Assume that Taylor, Inc. is operating at 85% of capacity. All costs and net working capital vary directly with sales. What is the amount of total fixed assets required if sales are projected to increase by 20 percent?

A) $12,840.00

B) $13,096.80

C) $13,108.68

D) $13,397.24

E) $13,414.14

Correct Answer:

Verified

Correct Answer:

Verified

Q139: The retention ratio is also known as

Q140: A Montreal firm currently has sales of

Q141: Baker's Dozen has current sales of $1,400

Q142: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt="

Q143: When utilizing the percentage of sales approach,

Q145: Which of the following firms would most

Q146: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" Rondolo,

Q147: The retention ratio is also called the

Q148: At the end of last year, a

Q149: Sales growth _.<br>A) Will typically lead to