Multiple Choice

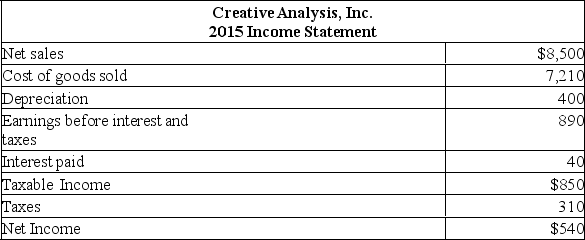

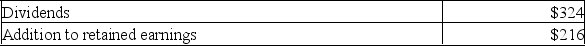

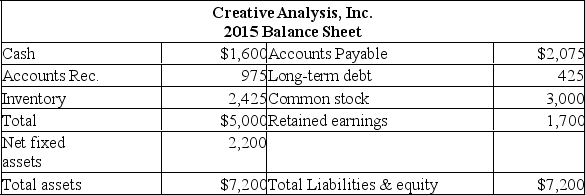

Creative Analysis, Inc. is currently operating at maximum capacity. All costs, assets, and current liabilities vary directly with sales. The tax rate and the dividend payout ratio will remain constant. How much additional debt is required if no new equity is raised and sales are projected to increase by 12%?

Creative Analysis, Inc. is currently operating at maximum capacity. All costs, assets, and current liabilities vary directly with sales. The tax rate and the dividend payout ratio will remain constant. How much additional debt is required if no new equity is raised and sales are projected to increase by 12%?

A) $169.08

B) $249.00

C) $322.08

D) $373.08

E) $399.00

Correct Answer:

Verified

Correct Answer:

Verified

Q204: Profit margin is a determinant of growth.

Q205: Long-range financial planning for a firm usually

Q206: One of the primary advantages of financial

Q207: Calculate the projected fixed assets needed given

Q208: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" How

Q210: Calculate retention ratio given the following information:

Q211: When a firm chooses to buy new

Q212: Which of the following is NOT a

Q213: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" Based

Q214: Financial planning focuses on:<br>A) The individual components