Multiple Choice

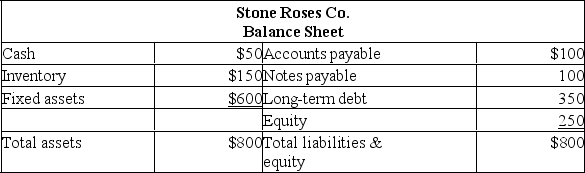

Suppose that current assets, costs, and accounts payable maintain a constant ratio to sales. The firm retains 40% of earnings. If the firm is producing at only 90% capacity, what is the total external financing needed if sales increase 25%?

Suppose that current assets, costs, and accounts payable maintain a constant ratio to sales. The firm retains 40% of earnings. If the firm is producing at only 90% capacity, what is the total external financing needed if sales increase 25%?

A) $1

B) $34

C) $41

D) $47

E) $94

Correct Answer:

Verified

Correct Answer:

Verified

Q354: The dividend policy decision is a basic

Q355: Calculate retention ratio given the following information:

Q356: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" Assets,

Q357: The percentage of sales approach to financial

Q358: Financial planning:<br>A) Is a static model.<br>B) Should

Q360: You are comparing the financial statements of

Q361: Decorative Interiors wants to maintain a growth

Q362: The following balance sheet and income statement

Q363: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt="

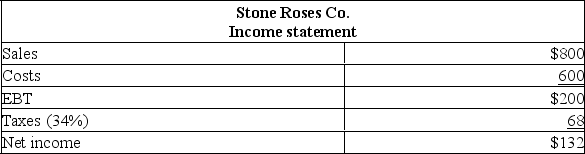

Q364: Calculate the external financing needed given the