Multiple Choice

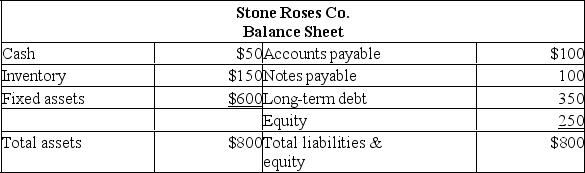

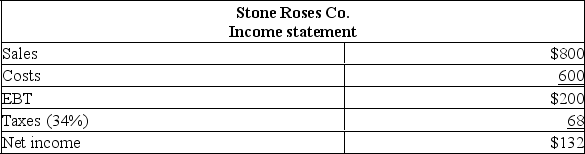

Suppose that assets and costs maintain a constant ratio to sales. The firm retains 30% of earnings. If the firm is producing at full capacity, what is the maximum growth rate (assuming no equity sales) that will maintain a constant debt-equity ratio?

Suppose that assets and costs maintain a constant ratio to sales. The firm retains 30% of earnings. If the firm is producing at full capacity, what is the maximum growth rate (assuming no equity sales) that will maintain a constant debt-equity ratio?

A) 5.2%

B) 15.6%

C) 18.8%

D) 21.0%

E) 29.2%

Correct Answer:

Verified

Correct Answer:

Verified

Q291: Guido's Garden Supplies has sales of $180,000,

Q292: Net income = $150; Total assets =

Q293: Shirley's Pastries expects sales of $253,000 next

Q294: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt="

Q295: In creating pro forma statements, if we

Q297: Calculate payout ratio given the following information:

Q298: The process by which smaller investment proposals

Q299: All else the same, an increase in

Q300: Calculate the projected fixed assets needed given

Q301: Financial planning:<br>A) Encourages managers to separate their