Multiple Choice

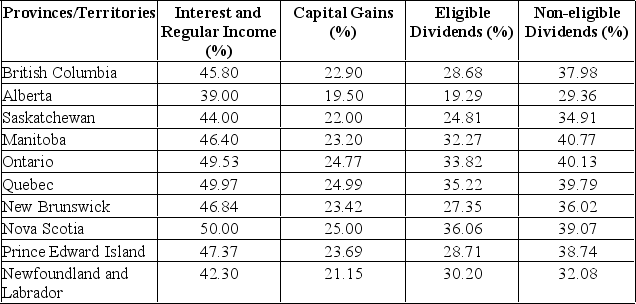

A Prince Edward Island resident earned $20,000 in interest income and $10,000 in capital gains. Calculate the total tax paid.

A) $9,843

B) $10,843

C) $11,843

D) $12,843

E) $13,843

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q318: The Phillip Edwards Co. has net income

Q319: A firm with negative net working capital

Q320: Financial leverage refers to:<br>A) The proportion of

Q321: The financial statement summarizing the value of

Q322: A Nova Scotia resident earned $20,000

Q324: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What

Q325: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" If a firm

Q326: The cost of an asset less the

Q327: Cash flow from assets is also known

Q328: Which one of the following will increase