Multiple Choice

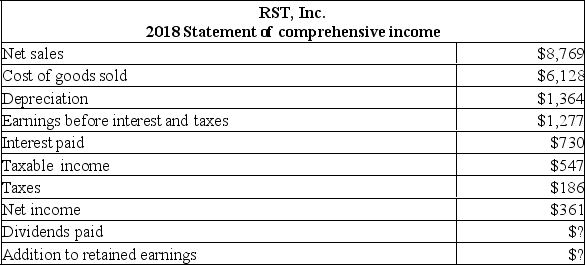

What is the average tax rate for 2018?

What is the average tax rate for 2018?

A) 19%

B) 25%

C) 34%

D) 39%

E) cannot be determined from the information provided

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q345: Liquid assets:<br>A) Are defined as current assets

Q346: Which one of the following will cause

Q347: Your _ tax rate measures the total

Q348: The asset category within the statement of

Q349: Alpha, Inc. earned $95,000 in net income

Q351: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What

Q352: Julie's Boutique paid $400 in dividends and

Q353: If an asset has a carrying value

Q354: A Saskatchewan resident earned $30,000 in

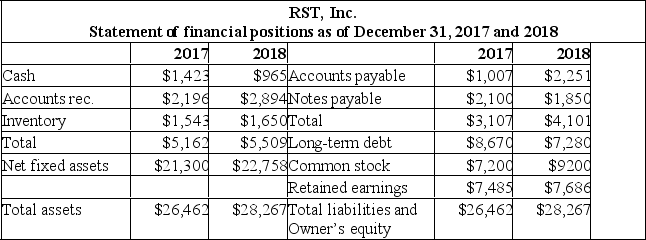

Q355: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What