Multiple Choice

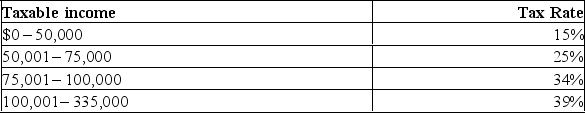

Given the tax rates below, what is the average tax rate for a firm with taxable income of $178,500?

A) 29.62 %

B) 30.13 %

C) 34.00 %

D) 35.67 %

E) 39.00 %

Correct Answer:

Verified

Correct Answer:

Verified

Q236: Shareholders' equity:<br>A) Includes common stock, paid in

Q237: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What

Q238: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What

Q239: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What

Q240: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What

Q242: A $40,000 asset was purchased and classified

Q243: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What is cash

Q244: The tax rates are as shown below.

Q245: A British Columbia resident earned $40,000

Q246: Which one of the following will decrease