Multiple Choice

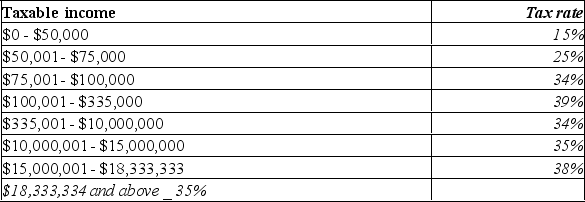

If a company has taxable income = $250,000, what is the average tax rate?

If a company has taxable income = $250,000, what is the average tax rate?

A) 32.3%

B) 34.0%

C) 36.8%

D) 39.6%

E) 42.0%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q208: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What

Q209: A decrease in which of the following

Q210: The Row Boat Cafe has operating cash

Q211: All-Rite sold $133,500 in used equipment in

Q212: The financial statement summarizing a firm's performance

Q214: Brandy's Candies paid $23 million in dividends

Q215: A firm has common stock of $5,500,

Q216: Janex Corporation had OCF of $250, net

Q217: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What

Q218: Non-cash items refer to expenses charged against