Multiple Choice

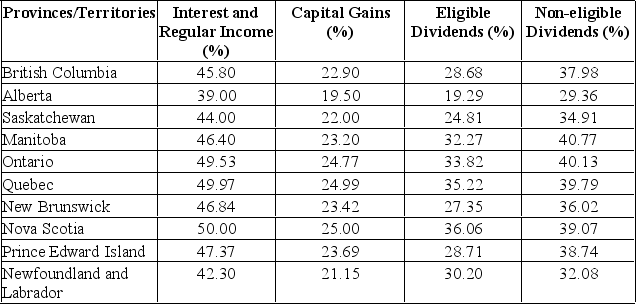

Calculate the tax difference between a British Columbia resident and an Ontario resident both having $20,000 in interest income and $25,000 in capital gains.

A) British Columbia resident would pay $1,213.50 more than the Ontario resident.

B) British Columbia resident would pay $1,213.50 less than the Ontario resident.

C) British Columbia resident would pay $1,456.50 more than the Ontario resident.

D) British Columbia resident would pay $1,456.50 less than the Ontario resident.

E) There are no tax differences between the two tax payers.

Correct Answer:

Verified

Correct Answer:

Verified

Q48: A $40,000 asset was purchased and classified

Q49: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What is the

Q50: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What is operating

Q51: Swell, Inc. had net fixed assets of

Q52: If provincial tax rates are 16% on

Q54: Amy's Dress Shoppe has sales of $421,000

Q55: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What is cash

Q56: Peter owns The Train Store which he

Q57: The financial statement showing a firm's accounting

Q58: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What