Multiple Choice

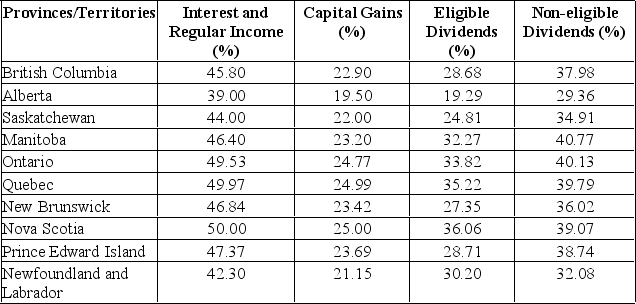

Calculate the tax difference between a British Columbia resident and a Quebec resident both having $20,000 in interest income and $25,000 in capital gains.

A) British Columbia resident would pay $1,356.50 less than the Quebec resident.

B) British Columbia resident would pay $1,356.50 more than the Quebec resident.

C) British Columbia resident would pay $2,456.50 less than the Quebec resident.

D) British Columbia resident would pay $2,456.50 more than the Quebec resident.

E) There are no tax differences between the two tax payers.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Knickerdoodles, Inc. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt="Knickerdoodles, Inc.

Q4: An impairment loss is defined as the

Q5: The R.J. Ramboldt Co. paid dividends of

Q6: Cash flow from assets must be negative

Q7: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What is the

Q9: A Saskatchewan resident earned $30,000 in

Q10: Calculate cash flow from assets given the

Q11: Which of the following are characteristics of

Q12: Impairment loss is the amount by which

Q13: The statement of financial position identity states