Multiple Choice

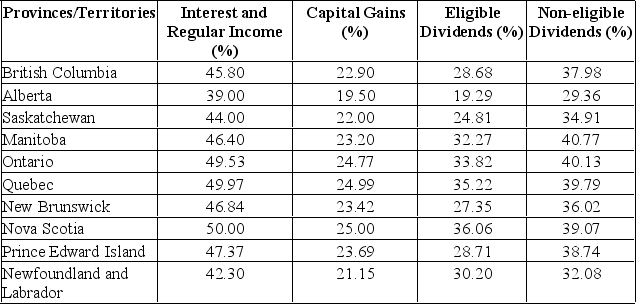

Calculate the tax difference between a British Columbia resident and an Alberta resident both having $20,000 in interest income and $25,000 in capital gains.

A) British Columbia resident would pay $2,210.00 more than the Alberta resident.

B) British Columbia resident would pay $2,210.00 less than the Alberta resident.

C) British Columbia resident would pay $3,500.00 more than the Alberta resident.

D) British Columbia resident would pay $3,500.00 less than the Alberta resident.

E) There are no tax differences between the two tax payers.

Correct Answer:

Verified

Correct Answer:

Verified

Q173: Which of the following equation is correct?<br>A)

Q174: Discuss how financial statement accounts are inter-connected

Q175: When net capital spending is a negative

Q176: Calculate earnings before interest and taxes given

Q177: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" If

Q179: _ refers to the net total cash

Q180: A new firm issued $500 in common

Q181: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What is the

Q182: The net new equity raised by a

Q183: _ refers to the firm's dividend payments