Multiple Choice

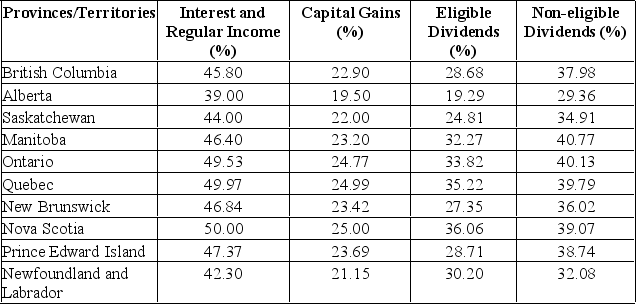

Calculate the tax difference between a British Columbia resident and an Ontario resident both having $20,000 in capital gains and $10,000 in eligible dividends. Combined marginal tax rates for individuals in top provincial tax brackets

A) British Columbia resident would pay $999.00 more than the Ontario resident.

B) British Columbia resident would pay $999.00 less than the Ontario resident.

C) British Columbia resident would pay $888.00 more than the Ontario resident.

D) British Columbia resident would pay $888.00 less than the Ontario resident.

E) There are no tax differences between the two tax payers.

Correct Answer:

Verified

Correct Answer:

Verified

Q264: A firm starts its year with a

Q265: Operating cash flow can be computed as:<br>A)

Q266: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What are earnings

Q267: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What is the

Q268: A firm has $300 in inventory, $600

Q270: If an asset has a carrying value

Q271: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What

Q272: Toby's Pizza has total sales of $987,611

Q273: The Corner Store paid $46 in dividends

Q274: If a firm's cash flow to stockholders