Multiple Choice

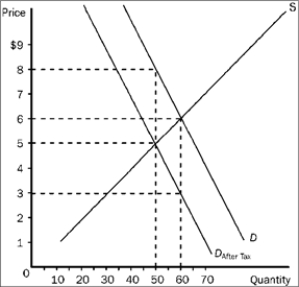

Figure 4-20

-Refer to Figure 4-20. The burden of the tax on sellers is

A) $1.00 per unit.

B) $1.50 per unit.

C) $2.00 per unit.

D) $3.00 per unit.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q160: A $25 government subsidy paid directly to

Q161: Suppose that a tax is placed on

Q162: The actual incidence (or burden) of a

Q163: In 2010 the federal government reduced the

Q164: The General Theory of John Maynard Keynes

Q166: Suppose that the federal government levies a

Q167: In a market economy, which of the

Q168: Which of the following is the most

Q169: Use the figure below to answer the

Q170: Lowincomesville is a poor town. The mayor