Multiple Choice

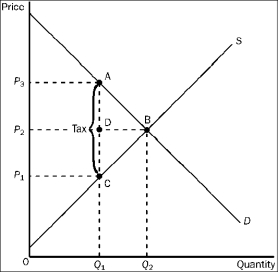

Figure 4-24

-Refer to Figure 4-24. The per unit burden of the tax on buyers is

A) P3 - P1.

B) P3 - P2.

C) P2- P1.

D) Q2 - Q1.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: After the ban on the production and

Q49: In the supply and demand model, a

Q61: Suppose an excise tax is imposed on

Q70: Figure 4-5 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-5

Q85: Use the figure below to answer the

Q192: If Aisha were to get a $3,000

Q193: An income tax is progressive if the<br>A)

Q196: When a price floor is above the

Q228: If Olivia's income increases from $40,000 to

Q230: Figure 4-17 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-17