Multiple Choice

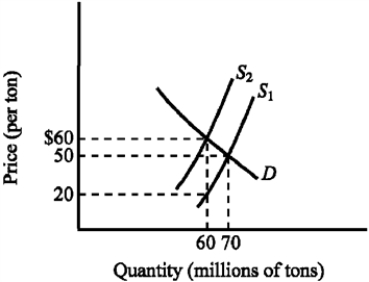

Use the figure below to answer the following question(s) .

Figure 4-8

-Refer to Figure 4-8. The supply curve S1 and the demand curve D indicate initial conditions in the market for soft coal. A $40-per-ton tax on soft coal is levied, shifting the supply curve from S1 to S2. Which of the following states the actual burden of the tax?

A) $10 for buyers and $30 for sellers

B) $30 for buyers and $10 for sellers

C) The entire $40 falls on sellers.

D) The entire $40 falls on buyers.

Correct Answer:

Verified

Correct Answer:

Verified

Q213: Figure 4-21 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-21

Q214: A minimum wage that is set above

Q215: An income tax is defined as regressive

Q216: When the top marginal tax rates were

Q217: Figure 4-18 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-18

Q219: A tax for which the average tax

Q220: Use the figure below to answer the

Q221: How would an increase in the price

Q222: The benefit of a subsidy will go

Q223: Emma works full time during the day