Multiple Choice

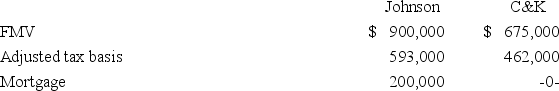

Johnson Inc.and C&K Company entered into an exchange of real property.Here is the information for the properties to be exchanged.  Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

A) $200,000 gain recognized; $662,000 basis in Johnson property.

B) No gain recognized; $462,000 basis in Johnson property.

C) No gain recognized; $487,000 basis in Johnson property.

D) None of the choices are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A taxpayer who exchanges property for an

Q11: Which of the following statements about boot

Q13: When unrelated parties agree to an exchange

Q25: If a taxpayer elected to defer a

Q27: Signo Inc.'s current year income statement includes

Q41: Babex Inc.and OMG Company entered into an

Q44: Eliot Inc.transferred an old asset with a

Q46: Loonis Inc.and Rhea Company formed LooNR Inc.by

Q48: Doppia Company transferred an old asset with

Q50: Which of the following statements about the