Multiple Choice

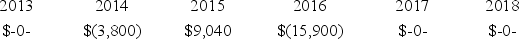

Proctor Inc.was incorporated in 2013 and adopted a calendar year.Here is a schedule of Proctor's net Section 1231 gains and (losses) reported on its tax returns through 2018.  In 2019,Proctor recognized a $25,000 gain on the sale of business land.How is this gain characterized on Proctor's tax return?

In 2019,Proctor recognized a $25,000 gain on the sale of business land.How is this gain characterized on Proctor's tax return?

A) $25,000 Section 1231 gain.

B) $19,700 ordinary gain and $5,300 Section 1231 gain.

C) $15,900 ordinary gain and $9,100 Section 1231 gain.

D) $25,000 ordinary gain.

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Milton Inc. recognized a $1,300 net Section

Q27: Mr. and Mrs. Churchill operate a small

Q41: Mrs. Stile owns investment land subject to

Q59: Winslow Company sold investment land to an

Q73: Netelli Inc. owned a tract of land

Q98: Four years ago, Mrs. Beights purchased marketable

Q99: Irby Inc.was incorporated in 2013 and adopted

Q102: Hugo Inc.,a calendar year taxpayer,sold two operating

Q109: Which of the following statements about Section

Q111: Princetown Inc. has a $4.82 million basis