Multiple Choice

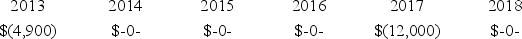

Delour Inc.was incorporated in 2013 and adopted a calendar year.Here is a schedule of Delour's net Section 1231 gains and (losses) reported on its tax returns through 2018.  In 2019,Delour recognized a $50,000 gain on the sale of business land.How is this gain characterized on Delour's tax return?

In 2019,Delour recognized a $50,000 gain on the sale of business land.How is this gain characterized on Delour's tax return?

A) $50,000 Section 1231 gain.

B) $12,000 ordinary gain and $38,000 Section 1231 gain.

C) $16,900 ordinary gain and $33,100 Section 1231 gain.

D) $50,000 ordinary gain.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A taxpayer that is using the installment

Q47: The abandonment of business equipment with a

Q50: In 2019,Mary recognized a $45,000 gain on

Q51: Andrew sold IBM stock to his sister

Q52: Firm F purchased a commercial office building

Q54: Mrs.Beld sold marketable securities with a $79,600

Q56: WQP Company generated $1,814,700 ordinary income from

Q72: A fire destroyed business equipment that was

Q84: CBM Inc. realized a $429,000 gain on

Q101: The seller's amount realized on the sale