Multiple Choice

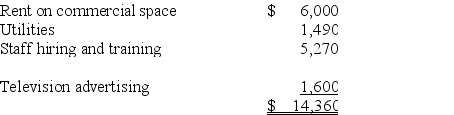

Puloso Company,a calendar year taxpayer,incurred the following start-up expenditures before the opening of its new health and fitness center.  The Puloso Center opened its doors for business on March 21 of the current year.How much of the start-up expenditures can Puloso deduct this year?

The Puloso Center opened its doors for business on March 21 of the current year.How much of the start-up expenditures can Puloso deduct this year?

A) -0-

B) $5,000

C) $5,520

D) $14,360

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Which of the following expenditures must be

Q21: Mallow Inc., which has a 21% tax

Q34: L&P Inc., which manufactures electrical components, purchased

Q90: Merkon Inc.must choose between purchasing a new

Q92: A basic premise of federal income tax

Q93: Molton Inc.made a $60,000 cash expenditure this

Q96: Shelley purchased a residential apartment for $1,400,000

Q97: BriarHill Inc.purchased four items of tangible personalty

Q98: Powell Inc.was incorporated and began operations on

Q99: Conant Company purchased only one item of