Essay

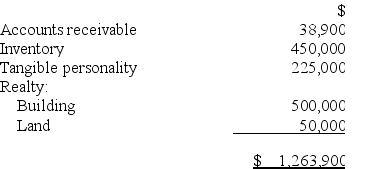

On May 1,Sessi Inc.,a calendar year corporation,purchased a business for a $2 million lump-sum price.The business' balance sheet assets had the following appraised FMV.

a.Compute the cost basis of the goodwill acquired by Sessi Inc.on the purchase of this business.

a.Compute the cost basis of the goodwill acquired by Sessi Inc.on the purchase of this business.

b.Compute Sessi's goodwill amortization deduction for the year of purchase.

c.Use a 21 percent tax rate to compute Sessi's deferred tax liability resulting from the amortization deduction.

Correct Answer:

Verified

Sessi's cost basis in purchased goodwill...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Cosmo Inc.paid $15,000 plus $825 sales tax

Q12: Research and experimental expenditures are not deductible

Q13: Which of the following intangible assets is

Q16: Inger Associates,which manufactures plastic containers,recently sold 12,000

Q17: Follen Company is a calendar year taxpayer.On

Q46: Stanley Inc., a calendar year taxpayer, purchased

Q63: Moses Inc. purchased office furniture for $8,200

Q67: Lovely Cosmetics Inc. incurred $785,000 research costs

Q100: Creighton, a calendar year corporation, reported $5,571,000

Q113: Essco Inc., a calendar year taxpayer, made