Multiple Choice

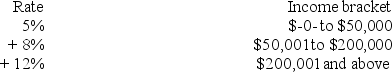

Jurisdiction M imposes an individual income tax based on the following schedule.  Ms.Owen has $314,000 taxable income.Compute the tax on this income.

Ms.Owen has $314,000 taxable income.Compute the tax on this income.

A) $29,680

B) $28,180

C) $37,680

D) None of the choices are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q24: The federal income tax law allows individuals

Q43: Tax systems with regressive rate structures result

Q48: Which of the following statements about the

Q48: Which of the following statements does not

Q52: Vervet County levies a real property tax

Q55: The city of Hartwell spends about $3

Q61: Which of the following statements about the

Q64: Changes in the tax law intended to

Q66: A tax meets the standard of efficiency

Q69: Assume the state of California plans to