Multiple Choice

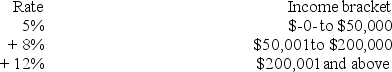

Jurisdiction M imposes an individual income tax based on the following schedule.  Which of the following statements is false?

Which of the following statements is false?

A) If Ms.Lui's taxable income is $33,400,her average tax rate is 5%.

B) If Mr.Bell's taxable income is $519,900,his marginal tax rate is 12%.

C) If Ms.Vern's taxable income is $188,000,her average tax rate is 7.2%.

D) None of the choices are false.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Jurisdiction M imposes an individual income tax

Q1: The city of Berne recently enacted a

Q2: Which of the following statements about a

Q7: Jurisdiction F levies a 10% excise tax

Q12: A tax should result in either horizontal

Q13: Jurisdiction P recently increased its income tax

Q16: A dynamic forecast of the incremental revenue

Q44: A progressive rate structure and a proportionate

Q54: Which of the following statements about a

Q68: Which of the following statements about the