Multiple Choice

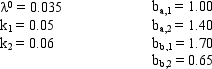

Under the following conditions, what are the expected returns for stocks A and B?

A) 14.8% and 13.8%

B) 19.8% and 29.5%

C) 16.0% and 19.8%

D) 16.9% and 15.9%

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q28: Consider a two-factor APT model where the

Q28: In a multifactor model,confidence risk represents<br>A) Unanticipated

Q34: Exhibit 9.2<br>USE THE INFORMATION BELOW FOR

Q35: Under the following conditions, what are the

Q36: Under the following conditions, what are the

Q42: One approach for using multifactor models is

Q49: Consider the following two factor APT

Q71: Findings by Basu that stocks with high

Q114: Findings by Fama and French that stocks

Q133: Studies strongly suggest that the CAPM be