Multiple Choice

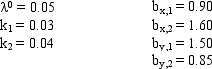

Under the following conditions, what are the expected returns for stocks X and Y?

A) 14.1% and 12.9%

B) 12.5% and 19.5%

C) 19.5% and 18.5%

D) 21.2% and 18.5%

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q11: The excess return form of the

Q16: Consider the following list of risk factors:

Q20: Under the following conditions, what are the

Q38: Exhibit 9.2<br>Use the Information Below for

Q39: In a micro-economic (or characteristic)based risk factor

Q41: Exhibit 9.2<br>Use the Information Below for

Q56: Studies indicate that neither firm size nor

Q66: Empirical tests of the APT model have

Q86: In the APT model the idea of

Q87: The APT assumes that security returns are