Multiple Choice

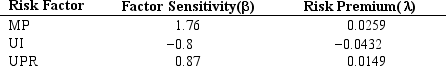

The table below provides factor risk sensitivities and factor risk premia for a three factor model for a particular asset where factor 1 is MP the growth rate in U.S. industrial production, factor 2 is UI the difference between actual and expected inflation, and factor 3 is UPR the unanticipated change in bond credit spread.  Calculate the expected excess return for the asset.

Calculate the expected excess return for the asset.

A) 12.32%

B) 9.32%

C) 4.56%

D) 6.32%

E) 8.02%

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Exhibit 9.2<br>USE THE INFORMATION BELOW FOR

Q25: In a macro-economic based risk factor model

Q36: Cho,Elton,and Gruber tested the APT by examining

Q46: Under the following conditions, what are the

Q48: The APT does not require a market

Q50: Exhibit 9.2<br>Use the Information Below for

Q51: Exhibit 9.2<br>USE THE INFORMATION BELOW FOR

Q58: Fama and French suggest a three factor

Q90: Two approaches to defining factors for multifactor

Q140: Multifactor models of risk and return can