Multiple Choice

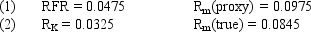

Assume that as a portfolio manager the beta of your portfolio is 0.85 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

A) 1.33% higher

B) 2.35% lower

C) 8% lower

D) 1.33% lower

E) 2.35% higher

Correct Answer:

Verified

Correct Answer:

Verified

Q18: An investor wishes to construct a portfolio

Q48: Exhibit 8.6<br>Use the Information Below for the

Q58: The Efficient Frontier refers to a set

Q61: All portfolios on the capital market line

Q63: The error caused by <b>not</b> using the

Q86: Assume that the risk-free rate of return

Q94: Exhibit 8.4<br>Use the Information Below for

Q100: Securities with returns that lie below the

Q117: Under the CAPM framework,the introduction of lending

Q121: Which of the following is <b>not </b>a