Multiple Choice

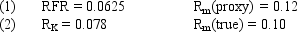

Assume that as a portfolio manager the beta of your portfolio is 1.15 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

A) 2.53% lower

B) 3.85% lower

C) 2.53% higher

D) 4.4% higher

E) 3.85% higher

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Which of the following variables were found

Q15: Calculate the expected return for A Industries

Q25: Exhibit 8.6<br>Use the Information Below for the

Q31: The existence of transaction costs indicates that

Q42: An investor constructs a portfolio with a

Q50: Exhibit 8.3<br>Use the Information Below for

Q58: Utilizing the security market line an investor

Q70: Consider an asset that has a beta

Q113: When identifying undervalued and overvalued assets,which of

Q116: The market portfolio consists of all<br>A) New