Multiple Choice

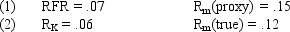

Assume that as a portfolio manager the beta of your portfolio is 1.1 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

A) 3.2% lower

B) 6.4% lower

C) 4.9% lower

D) 3.2% higher

E) 6.4% higher

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Exhibit 8.1<br>USE THE INFORMATION BELOW FOR

Q5: Assume that as a portfolio manager the

Q49: A friend has information that the stock

Q61: Studies have shown that a well-diversified investor

Q71: The betas of those companies compiled by

Q75: Studies have shown the beta is more

Q109: Recently you have received a tip that

Q115: Exhibit 8.2<br>Use the Information Below for

Q121: Which of the following is <b>not </b>a

Q152: The Capital Market Line (CML) refers only