Multiple Choice

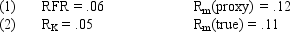

Assume that as a portfolio manager the beta of your portfolio is 1.4 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

A) 2.0% lower

B) 0.5% lower

C) 0.5% lower.

D) 1.0% higher

E) 2.0% higher

Correct Answer:

Verified

Correct Answer:

Verified

Q28: The rate of return on a risk

Q29: If an individual owns only one security

Q54: The expected return for a stock,calculated using

Q55: If an incorrect proxy market portfolio such

Q62: There can be only one zero-beta portfolio.

Q73: Exhibit 8.7<br>Use the Information Below for

Q77: The separation theorem divides decisions on _

Q87: Exhibit 8.1<br>USE THE INFORMATION BELOW FOR

Q92: Assume that as a portfolio manager the

Q97: In the presence of transactions costs,the SML