Multiple Choice

Table 18-6

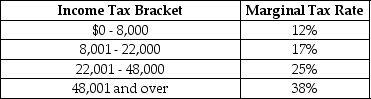

Table 18-6 shows the income tax brackets and tax rates for single taxpayers in Calpernia.

Table 18-6 shows the income tax brackets and tax rates for single taxpayers in Calpernia.

-Refer to Table 18-6. How much income tax does Sasha pay if she is a single taxpayer with an income of $60,000?

A) $22,800

B) $14,400

C) $13,800

D) $13,642

Correct Answer:

Verified

Correct Answer:

Verified

Q134: Which of the following is not an

Q155: Table 18-1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Table 18-1

Q156: The idea that two taxpayers in the

Q164: The Arrow impossibility theorem explains<br>A)why there is

Q188: Some individuals seek to use government action

Q210: A tax bracket is<br>A)the percent of taxable

Q211: The largest source of revenue for the

Q232: A Lorenz curve summarizes the information provided

Q238: According to the horizontal-equity principle of taxation,<br>A)individuals

Q256: Article Summary<br>State tax revenue from marijuana sales