Essay

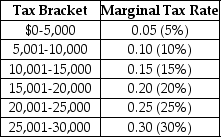

Last year, Anthony Millanti earned exactly $30,000 of taxable income. Assume that the income tax system used to determine Anthony's tax liability is progressive. The table below lists the tax brackets and the marginal tax rates that apply to each bracket.

a. Draw a new table that lists the amounts of income tax that Anthony is obligated to pay for each tax bracket, and the total tax he owes the government. (Assume that there are no allowable tax deductions, tax credits, personal exemptions, or any other deductions that Anthony can use to reduce his tax liability).

b. Determine Anthony's average tax rate.

Correct Answer:

Verified

a.

b. The average tax rate i...

b. The average tax rate i...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: There is a difference between who is

Q34: Absolute poverty measures vary from country to

Q37: Which of the following tax systems would

Q38: An example of a payroll tax in

Q61: From 1970 to 2010, the poverty rate

Q73: The actual division of the burden of

Q153: What is meant by the term "rational

Q175: In reference to the federal income tax

Q194: The federal government and some state governments

Q216: The median voter theorem will be an