Essay

Figure 18-3

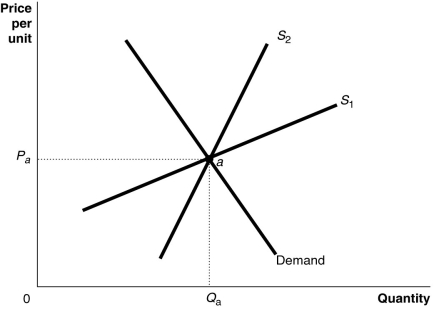

-Refer to Figure 18-3. The figure above shows a demand curve and two supply curves, one more elastic than the other. Use Figure 18-3 to answer the following questions.

a. Suppose the government imposes an excise tax of $1.00 on every unit sold. Use the graph to illustrate the impact of this tax when the supply curve is S1 and when the supply curve is S2.

b. If the government imposes an excise tax of $1.00 on every unit sold, will the consumer pay more of the tax if the supply curve is S1 or S2? Refer to the graphs in your answer.

c. If an excise tax of $1.00 on every unit sold is imposed, will the revenue collected by the government be greater if the supply curve is S1 or S2?

d. If the government imposes an excise tax of $1.00 on every unit sold, will the deadweight loss be greater if the supply curve is S1 or S2?

Correct Answer:

Verified

a. The supply curve shifts up by the ful...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Table 18-5<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Table 18-5

Q48: Since lower-income people spend a larger proportion

Q51: What is a Lorenz curve and what

Q62: Holding all other factors constant, income earned

Q87: Economist Kenneth Arrow has shown mathematically that

Q104: The government of Silverado raises revenue to

Q144: What is logrolling?<br>A)a situation where a policymaker

Q161: The actual division of a tax between

Q163: Figure 18-2 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7397/.jpg" alt="Figure 18-2

Q253: A tax is efficient if<br>A)individuals with the