Essay

Figure 4-19

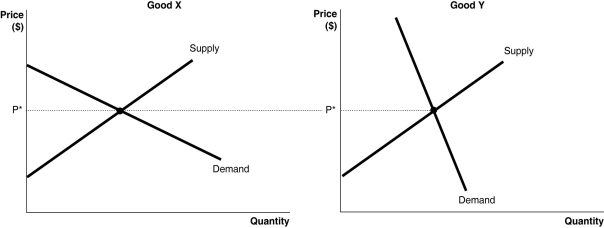

-Refer to Figure 4-19. The figure above illustrates the markets for two goods, Good X and Good Y. Suppose an identical dollar tax is imposed on sellers in each market.

a. Compare the consumer burden and producer burden in each market. Illustrate your answer graphically.

b. If the goal of the government is to raise revenue with minimum impact to quantity consumed, in which market should the tax be imposed?

c. If the goal of the government is to discourage consumption, in which market should the tax be imposed?

Correct Answer:

Verified

a. See the figure be...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q36: What is the difference between scarcity and

Q72: Suppose an excise tax of $1 is

Q83: Table 4-13<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7397/.jpg" alt="Table 4-13

Q84: Table 4-6<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7397/.jpg" alt="Table 4-6

Q87: The additional benefit to a consumer from

Q88: Figure 4-14 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7397/.jpg" alt="Figure 4-14

Q91: Figure 4-5 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7397/.jpg" alt="Figure 4-5

Q97: Government intervention in agricultural markets in the

Q119: The total amount of producer surplus in

Q212: Government intervention in agriculture began in the