Multiple Choice

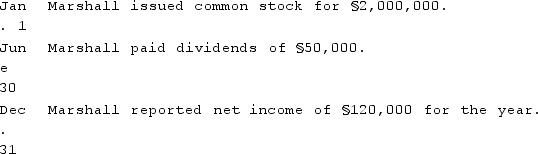

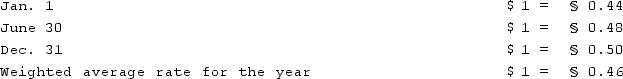

Marshall Co. was formed on January 1, 2021 as a wholly owned foreign subsidiary of a U.S. corporation. Marshall's functional currency was the stickle (§) . The following transactions and events occurred during 2021:  Exchange rates for 2021 were:

Exchange rates for 2021 were:  What was the amount of the translation adjustment for 2021?

What was the amount of the translation adjustment for 2021?

A) $119,000 decrease in relative value of net assets.

B) $121,000 decrease in relative value of net assets.

C) $81,000 increase in relative value of net assets.

D) $59,000 decrease in relative value of net assets.

E) $170,000 increase in relative value of net assets.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Dilty Corp. owned a subsidiary in France.

Q25: Esposito is an Italian subsidiary of a

Q26: Under the temporal method, retained earnings would

Q27: A net liability balance sheet exposure exists

Q28: Under the temporal method, inventory at net

Q30: Under the current rate method, property, plant

Q31: A subsidiary of Reynolds Inc., a U.S.

Q32: Gale Co. was formed on January 1,

Q33: How can a parent corporation determine the

Q34: Oscar, Ltd. is a British subsidiary of