Essay

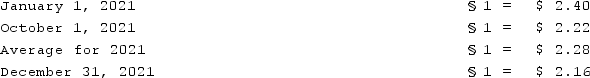

Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2021 by acquiring all of the common stock for §50,000 Stickles, the local currency. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2022. A building was then purchased for §170,000 on January 1, 2021. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2021. The functional currency for the subsidiary was the Stickle (§). Currency exchange rates were as follows:  Prepare an income statement for this subsidiary in stickles and then translate these amounts into U.S. dollars.

Prepare an income statement for this subsidiary in stickles and then translate these amounts into U.S. dollars.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: A foreign subsidiary uses the first-in first-out

Q19: Quadros Inc., a Portuguese firm was acquired

Q20: Ginvold Co. began operating a subsidiary in

Q21: Gale Co. was formed on January 1,

Q22: Quadros Inc., a Portuguese firm was acquired

Q24: Dilty Corp. owned a subsidiary in France.

Q25: Esposito is an Italian subsidiary of a

Q26: Under the temporal method, retained earnings would

Q27: A net liability balance sheet exposure exists

Q28: Under the temporal method, inventory at net