Essay

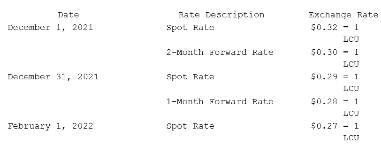

On December 1, 2021, King Co. sold inventory to a customer in a foreign country. King agreed to accept 96,000 local currency units (LCU) in full payment for this inventory. Payment was to be made on February 1, 2022. On the date of sale, King entered into a forward exchange contract wherein 96,000 LCU would be delivered to a currency broker in two months. The two-month forward exchange rate on that date was 1 LCU = $0.30. Any contract discount or premium is amortized using the straight-line method. The spot rates and forward rates on various dates were as follows:  The company's borrowing rate is 12%. The present value factor for one month is 0.9901.(A.) Assume this hedge is designated as a fair value hedge. Prepare the journal entries relating to the transaction and the forward contract.(B.) Compute the effect on 2021 net income.(C.) Compute the effect on 2022 net income.

The company's borrowing rate is 12%. The present value factor for one month is 0.9901.(A.) Assume this hedge is designated as a fair value hedge. Prepare the journal entries relating to the transaction and the forward contract.(B.) Compute the effect on 2021 net income.(C.) Compute the effect on 2022 net income.

Correct Answer:

Verified

Correct Answer:

Verified

Q22: To account for a forward contract cash

Q23: What happens when a U.S. company purchases

Q24: On May 1, 2021, Mosby Company received

Q25: What are the two separate transactions that

Q26: A U.S. company sells merchandise to a

Q28: Coyote Corp. (a U.S. company in Texas)

Q29: Clark Stone purchases raw material from its

Q30: Which is a true statement regarding the

Q31: Clark Co., a U.S. corporation, sold inventory

Q32: On December 1, 2021, Joseph Company, a