Multiple Choice

Cement Company, Inc. began the first quarter with 1,000 units of inventory costing $25 per unit. During the first quarter, 3,000 units were purchased at a cost of $40 per unit, and sales of 3,400 units at $65 per units were made. During the second quarter, the company expects to replace the units of beginning inventory sold at a cost of $45 per unit. Cement Company uses the LIFO method to account for inventory.What is the correct journal entry to record cost of goods sold at the end of the first quarter?

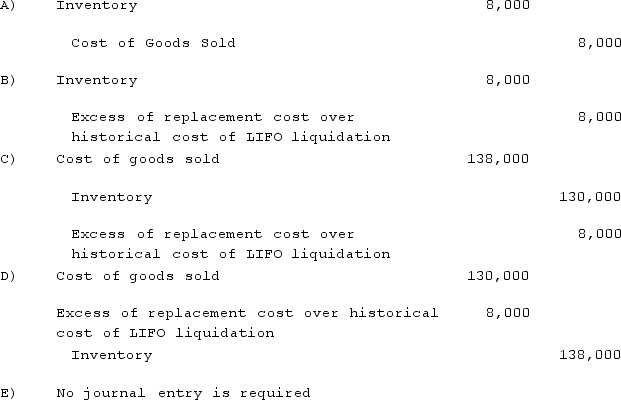

A) Option A.

B) Option B.

C) Option C.

D) Option D.

E) Option E.

Correct Answer:

Verified

Correct Answer:

Verified

Q107: Which items of information are required to

Q108: Which tests must a company use to

Q109: Blanton Corporation is comprised of five operating

Q110: Betsy Kirkland, Inc. incurred a flood loss

Q111: Baker Corporation changed from the LIFO method

Q113: How should seasonal revenues be reported in

Q114: Peterson Corporation has three operating segments with

Q115: Nigel Corp. had six different operating segments

Q116: The following information for Urbanski Corporation relates

Q117: Harrison Company, Inc. began operations on January