Multiple Choice

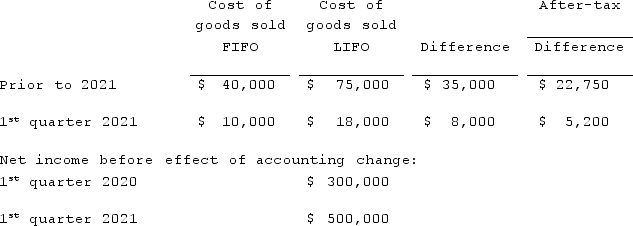

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2021. Baker has an effective income tax rate of 35% and 100,000 shares of common stock issued and outstanding. The following additional information is available:  Assuming Baker makes the change in the first quarter of 2021 and that $400,000 net income is earned during the second quarter, how much is reported as net income for the second quarter of 2021?

Assuming Baker makes the change in the first quarter of 2021 and that $400,000 net income is earned during the second quarter, how much is reported as net income for the second quarter of 2021?

A) $400,000.

B) $405,200.

C) $427,950.

D) $894,850.

E) $905,200.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Schilling, Inc. has three operating segments with

Q2: Elektronix, Inc. has three operating segments with

Q4: What is the purpose of the U.S.

Q5: Which one of the following items is

Q6: On February 23, 2021, Cleveland, Inc. paid

Q7: Which of the following is reported for

Q8: Faru Co. identified five industry segments: (1)

Q9: Thompson Corp. was engaged solely in manufacturing

Q10: Which of the following is not a

Q11: According to U.S. GAAP, what general information