Multiple Choice

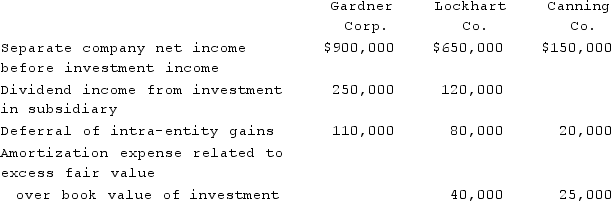

Gardner Corp. owns 80% of the voting common stock of Lockhart Co. Lockhart owns 70% of Canning Co. Gardner and Lockhart both use the initial value method to account for their investments. The following information is available from the financial statements and records of the three companies:  Separate company net income includes intra-entity gains before the consolidating deferral but does not include dividend income from investment in subsidiary.What amount should be reported for consolidated net income?

Separate company net income includes intra-entity gains before the consolidating deferral but does not include dividend income from investment in subsidiary.What amount should be reported for consolidated net income?

A) $1,425,000.

B) $1,490,000.

C) $1,525,000.

D) $1,635,000.

E) $1,700,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q44: Britain Corporation acquires all of English, Inc.

Q45: On January 1, 2021, Harley Company bought

Q46: D Corp. had investments, direct and indirect,

Q47: Under what conditions must a deferred income

Q48: Delta Corporation owns 90% of Sigma Company,

Q50: Horse Corporation acquires all of Pony, Inc.

Q51: How does the treatment of intra-entity gains

Q52: Gardner Corp. owns 80% of the voting

Q53: White Company owns 60% of Cody Company.

Q54: Wilkins Inc. owned 60% of Motumbo Co.