Multiple Choice

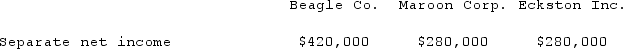

Beagle Co. owned 80% of Maroon Corp. Maroon owned 90% of Eckston Inc. Separate company net incomes for 2021 are shown below; these figures contained no investment income. Amortization expense was not required by any of these acquisitions. Included in Eckston's operating income was a $56,000 gross profit on intra-entity transfers to Maroon.  The accrual-based net income of Eckston Inc. is calculated to be

The accrual-based net income of Eckston Inc. is calculated to be

A) $234,000.

B) $211,000.

C) $221,000.

D) $224,000.

E) $246,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q31: For each of the following situations, select

Q32: Beagle Co. owned 80% of Maroon Corp.

Q33: How is the amortization of goodwill treated

Q34: Kurton Inc. owned 90% of Luvyn Corp.'s

Q35: On January 1, 2021, Youder Inc. bought

Q37: In a father-son-grandson combination, which of the

Q38: What are the essential criteria for including

Q39: What ownership structure is referred to as

Q40: For each of the following situations, select

Q41: In a tax-free business combination,<br>A) The income