Multiple Choice

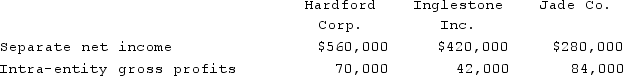

Hardford Corp. held 80% of Inglestone Inc., which, in turn, owned 80% of Jade Co. Excess amortization expense was not required by any of these acquisitions. Separate net income figures (without investment income) as well as upstream intra-entity gross profits (before deferral) included in the income for the current year follow:  The net income attributable to the noncontrolling interest of Inglestone Inc. is calculated to be

The net income attributable to the noncontrolling interest of Inglestone Inc. is calculated to be

A) $106,950.

B) $102,640.

C) $114,530.

D) $106,960.

E) $103,680.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: For each of the following situations, select

Q5: For each of the following situations, select

Q6: Gardner Corp. owns 80% of the voting

Q7: Chase Company owns 80% of Lawrence Company

Q8: Woof Co. acquired all of Meow Co.

Q10: Paris, Inc. owns 80% of the voting

Q11: On January 1, 2020, Mace Co. acquired

Q12: Chapman Co. acquired all of Klein Co.

Q13: On January 1, 2020, Jones Company bought

Q14: Evanston Co. owned 60% of Montgomery Corp.